Forex Today: US Dollar struggles to extend rebound ahead of key US data

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

- AUD/USD sticks to gains above 0.6600, highest since late October after Aussie trade data

- AUD/USD holds steady above 0.6600; remains close to two-month high ahead of US PCE data

Here is what you need to know on Friday, August 15:

The US Dollar (USD) finds it difficult to hold its ground after posting gains against its major rivals on Thursday. The US economic calendar will feature Retail Sales and Industrial Production data for July. Later in the session, the University of Michigan will publish the preliminary Consumer Sentiment Survey for August, which will feature Consumer Confidence Index and 1-year Consumer Inflation Expectations figures.

US Dollar PRICE This week

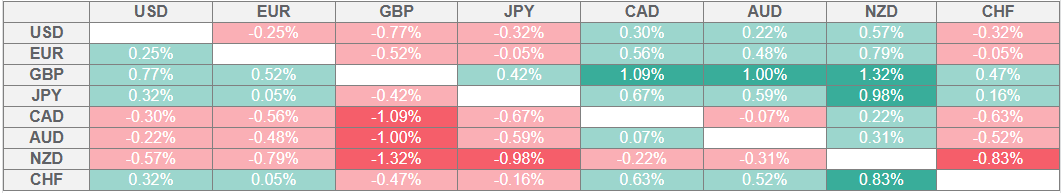

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Ahead of the weekend, investors will also pay close attention to headlines coming out of the highly-anticipated meeting between US President Donald Trump and Russian President Vladimir Putin in Alaska.

The USD gathered strength on Thursday after the Bureau of Labor Statistics (BLS) reported that annual producer inflation, as measured by the change in the Producer Price Index (PPI), jumped to 3.3% in July from 2.4% in June. In this period, the core PPI rose by 3.7% on a yearly basis, up sharply from the 2.6% increase recorded in June.

In the Asian session on Friday, the data from China showed Retail Sales grew by 3.7% on a yearly basis in July. This reading fell short of the market expectation of 4.6%. Additionally, Industrial Production Expanded by 5.7%, following the 6.8% increase reported in the previous month. After losing nearly 0.8% on Thursday, AUD/USD stages a rebound early Friday and trades in positive territory, slightly above 0.6500.

USD/JPY stays under bearish pressure and trades near 147.00 after closing marginally higher on Thursday. Japan's Gross Domestic Product (GDP) expanded at an annual rate of 1% in the second quarter. This print followed the 0.6% expansion recorded in the previous quarter and came in better than the market expectation of 0.4%.

EUR/USD stays in positive territory above 1.1650 after closing in the red on Thursday. The European economic calendar will not offer any high-impact data releases on Friday.

Following the strong rally seen in the first half of the week, GBP/USD lost its traction and fell more than 0.3% on the day on Thursday. The pair shakes off the bearish pressure in the European session on Friday and trades slightly above 1.3550.

Gold turned south and lost more than 0.5% on Thursday as US Treasury bond yields pushed higher following the hot producer inflation data. XAU/USD holds steady in the European morning on Friday and trades below $3,350.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.