Buy and sell the world's most popular cryptocurrencies.

Discover the unique benefits of CFD Crypto trading with Mitrade.

Buy and sell the world's most popular cryptocurrencies.

Discover the unique benefits of CFD Crypto trading with Mitrade.

| Name | Sell | 24H Change |

|---|

In both cases, the aim is to profit from price differences.

Cryptocurrency can be traded as a derivative under CFDs, which means you only speculate on the movement of the price without owning the real currencies.

You simply use a CFD broker account to buy (go long) if you predict that the price of a crypto will increase, or you can sell (go short) if you predict that the price will fall.

Trading cryptocurrencies using CFDs allows one to use leverage, whereby the trader only deposits a fraction of the required sum to acquire a specific amount of cryptocurrency.

Leveraged trading magnifies both profits and losses.

Trading cryptocurrencies via an exchange involves the buying and selling of the real coins.

You need to create an account on the exchange, decide the amount of coins you need, pay the full value of their worth, then store the cryptocurrency in a wallet until you are ready to sell them.

Exchange trading requires the trader to study the entire process before it can make sense to them.

Some exchanges might have expensive maintenance costs and a limit on how much you can transact.

Open a trading account at Mitrade and get started trading cryptocurrencies with an ASIC-regulated broker today!

Start Trading| Crypto CFDs Trading | Owning Crypto | |

|---|---|---|

| Profits when crypto prices rise (long) | ||

| Profits when crypto prices fall (short) | ||

| Margin trading | ||

| Volatility trading (without owning the asset or holding an exchange account) | ||

| Lock profits and minimize losses with risk management tools | ||

| No exchange fees | ||

| No digital wallet required | ||

| Less security risk of hacking or crypto theft | ||

| No trading commissions | ||

| Regulated trading platforms |

Open a trading account at Mitrade and get started trading cryptocurrencies with an ASIC-regulated broker today!

Get StartedFirst, make sure you know whether to buy and sell real cryptocurrency or you want to make money by predicting the prices of the crypto.

Once you have signed up with your preferred provider, it is time to deposit money so you can start trading. Different brokers have varying methods of accepting your deposit such as credit cards, bank transfers, e-wallets, and so on.

Finally, you can buy and sell the cryptocurrencies that you want (exchange) or open a trade on the price of a crypto (CFD).

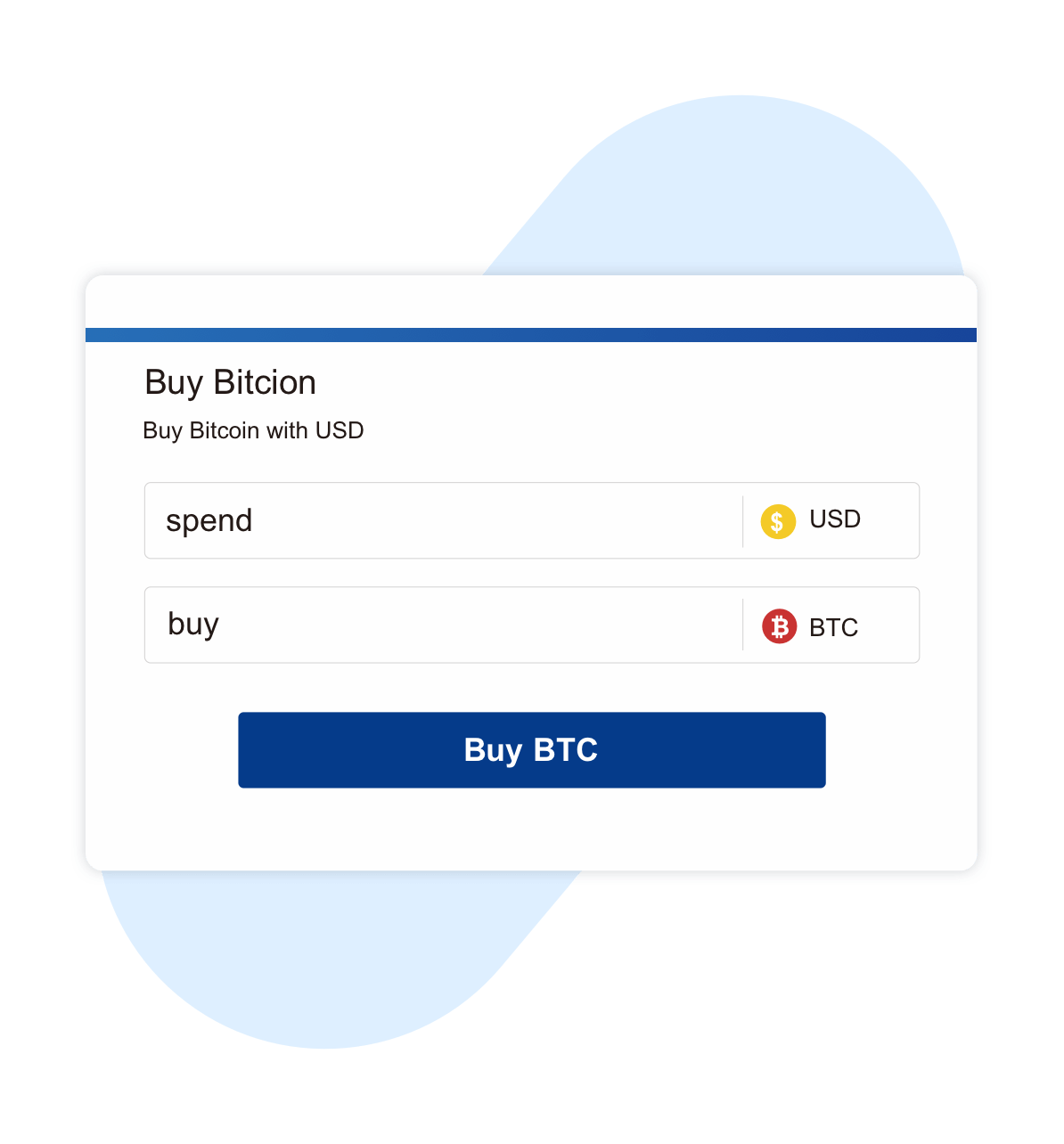

You must sign up to trade with any broker. This ensures the broker knows you and can keep your money and details safe by making sure only the authorized person accesses your account.

To sign up, go to Mitrade.com and click on “Create Account.”

You will go through this simple process of recording your basic details as shown:

Once you have cleared all the above steps, you will have your account verified within 24 hours.

After that, you can deposit money.

You can choose from any of these deposit methods:

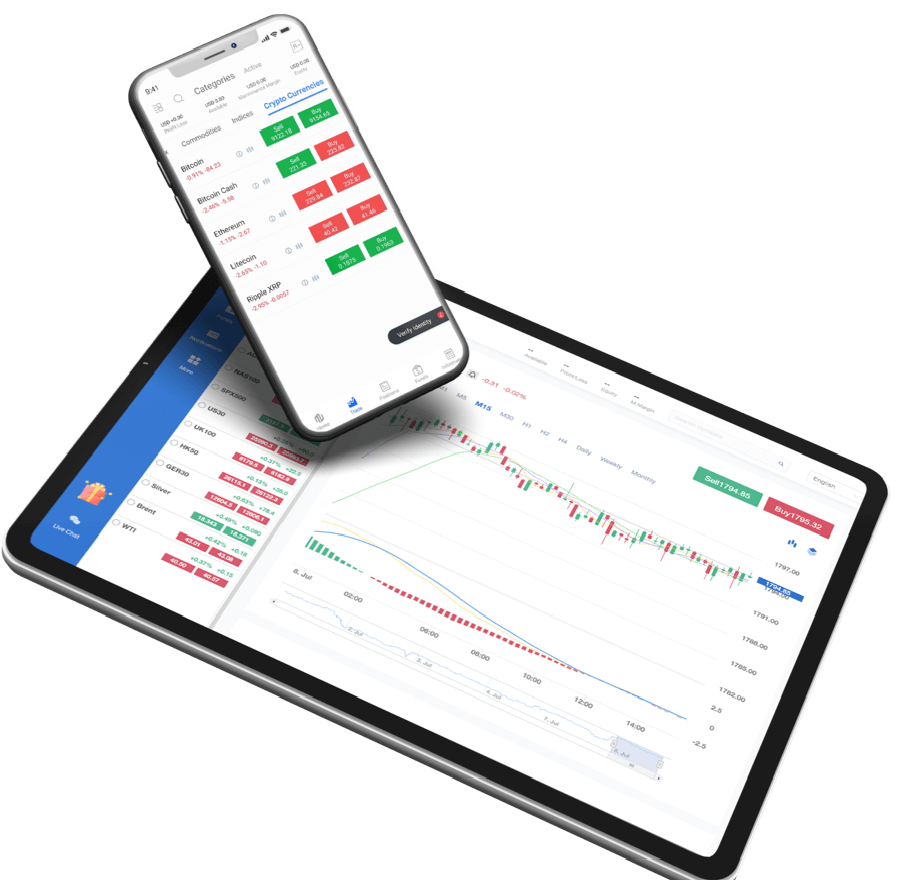

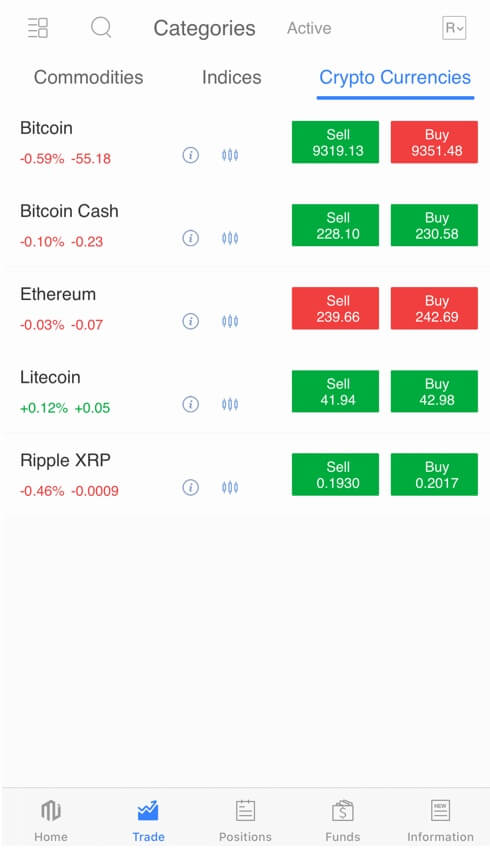

Once you have deposited the desired amount, go to the “Trade” button at the top-left side of your screen and click on it.

Then select “Crypto Currencies” in the active area that will appear next to the “Trade” button.

A list of the crypto that Mitrade offers will appear as shown.

What you have to do next is to select the crypto that you wish to trade by clicking on it. Its chart will load on the right side of the screen.

Next, if your analysis says the price will go up, click on “Buy” to start a long trade; or, if you think the price will go down, click “Sell” to start a short trade.

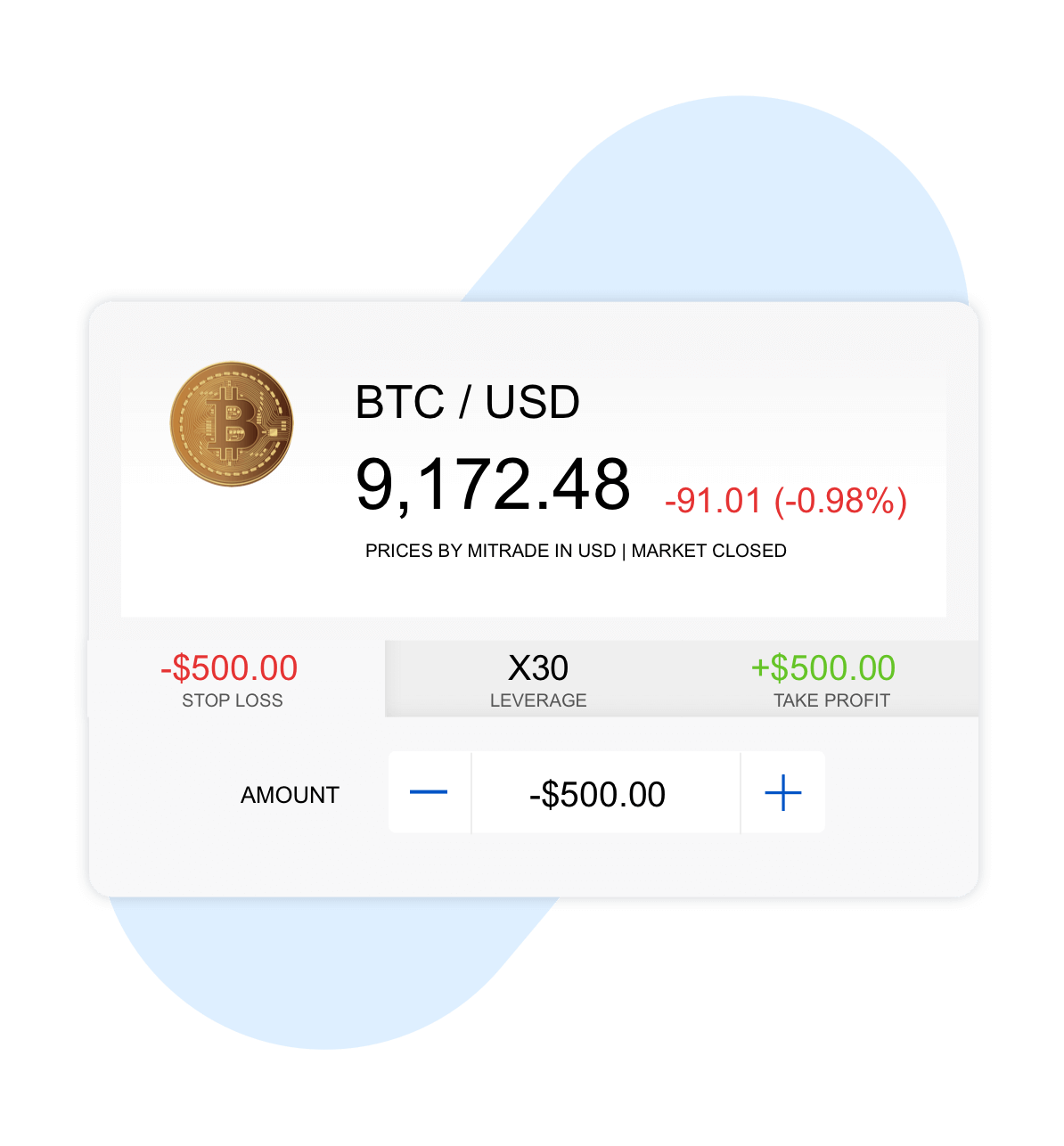

After clicking the "Buy" or "Sell" button, you can further set up the trade.

Let's say this is a Bitcoin Sell trade.

Once you have filled these fields according to your trading plan, you can click “Sell” and your trade will be executed.

From there, you can monitor your trade and see your profits or losses by clicking on the “Positions” tab.

When you want to close the trade, click on the “Close” button located on the upper-right corner of your chart.

There, you did! You just made your first cryptocurrency CFD trade!

Finally, when you want to withdraw your earnings, simply click on the “Funds” tab on your screen then click “Withdrawal”.

You will be directed to a dialogue box where you can choose the amount and method to use in withdrawing your profits.

As you can tell, the Mitrade trading process and interface is very simple even for beginners.

Ready to get started trading Cryptos on Mitrade?

Create your FREE accountAll CFD Brokers and Cryptocurrency exchanges are unique in terms of their characteristics.

So, how to select the one that best suits your need?

Here are some key criteria to consider:

Cryptocurrencies are yet to be fully accepted and regulated, so it might be hard to find a regulated exchange. Even when one claims to be, you will hardly have anyone investigating your claims since this is still an emerging industry that authorities are yet to fully supervise.

However, when you trade cryptocurrency through a regulated CFD broker, then you could relax a bit. A CFD broker who is fully regulated by a credible body is less likely to practise fraud than those un-regulated exchanges.

Therefore, if you want to take the risk of holding real cryptos, an exchange is for you. However, if you prefer the peace of mind of knowing your money is safe and secure, just try to make money from the crypto price difference, then opt for a regulated CFD broker.

Leverage or margin trading is a new favorite method of making huge profits from a small deposit where the broker “lends” the trader more funds over their capital.

So, if you want to make a lot more money with less deposit, go for CFD crypto trading. For instance, with a balance of $1,000, you can move crypto worth $100,000 if you use a leverage of 100:1.

However, if you think leverage trading is too risky, then stick with exchange crypto trading.

Consider which type of crypto trades you want to place. There are three following types of crypto trading:

For example, if you want to trade BTC with USD, you’ll need to find a crypto broker that allows you to buy cryptos via bank transfer or card.

Similarly, if you want to exchange your BTC or ETH holdings for another cryptocurrency, you’ll want a platform that offers direct crypto-to-crypto trades.

Beginners need trading platforms that are user-friendly and overly straight-forward.

Experienced traders, on their part, need platforms that have advanced charting and analytical tools as well as margin trading support.

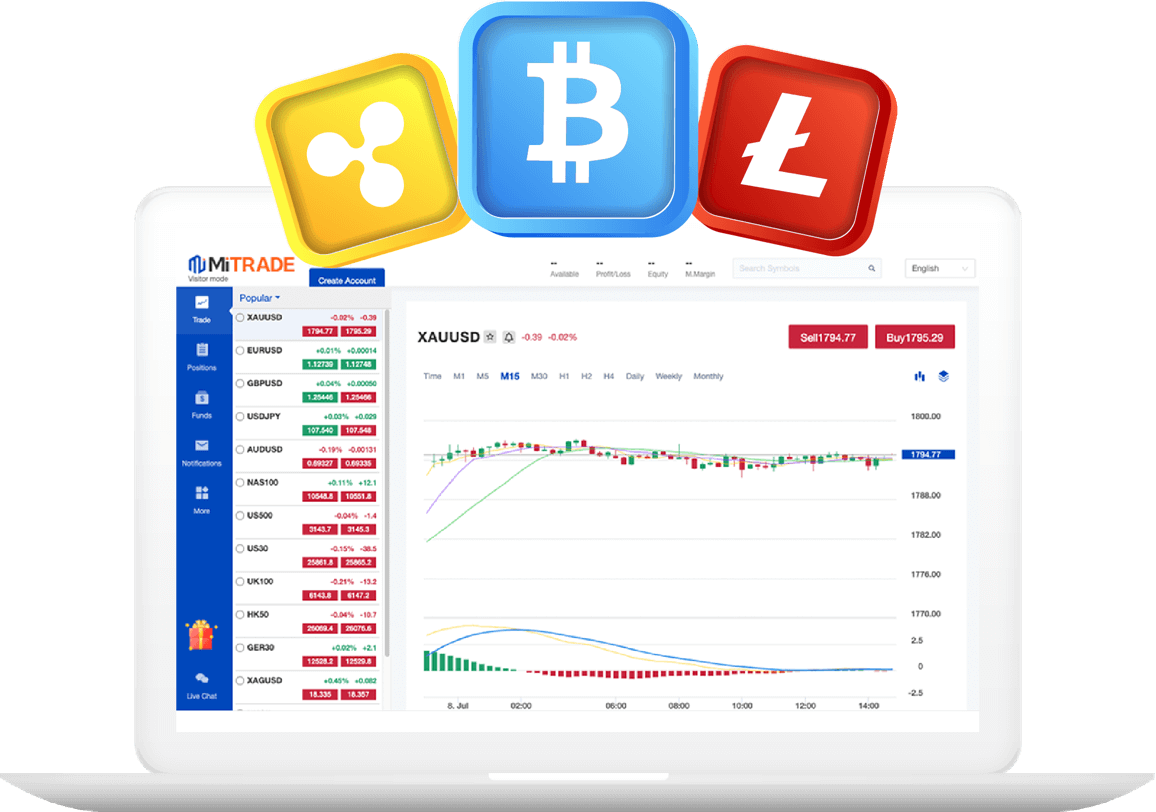

Mitrade has a simple web-based platform that is suitable for both novice and experienced cryptocurrency traders.

The liquidity of a market determines the ease and speed to open a crypto trade.

Higher liquidity is mostly found in big exchanges since there are many traders available, meaning there is a lot of volume per given time.

The advantage of using CFD brokers is that there are always available traders ready to buy or sell at any given moment, 24 hours a day.

In short, when using an exchange, you might not always have a ready buyer or seller to accept your offer since they have limited liquidity.

On the other hand, when using a CFD broker, your buy or sell orders will be accepted and executed within seconds of you placing the order.

Customer support should be one of the most crucial factors to consider when choosing a broker or exchange.

Consider the following factors when evaluating the customer support of your preferred broker or exchange:

Choose any exchange or broker that can provide lower trading fees.

Some specific fees to check out include withdrawal and deposit fees, costs per trade, and commissions, as well as some unexplainable deductions.

It has become common to hear of exchanges that have been hacked and the users lost their coins.

Therefore, investigating the type of security offered by your preferred exchange or broker is also very important.

Ask yourself questions like:

And so on.

You will either hold the cryptos on exchanges or exchange-based wallets.

Experts warn that holding cryptocurrency on exchanges or exchange-based wallets for long is unsafe. This is because the exchanges keep the private keys of the wallets, meaning the user does not have full control over their money.

This is yet another reason to trade on regulated Crypto CFDs which are more secure as you don’t need the real coins and the trustable CFD brokers are always regulated .

All cryptocurrencies are unique and they offer varying benefits and risks to the trader. As such, there is no one perfect coin to trade.

The factors that determine a trader’s preference of the crypto to trade include risk appetite, volatility, and trading goals.

On that note, Mitrade has paired the most traded cryptocurrencies against fiat currencies which are:

Crypto markets move as per the availability of supply and demand. When there is too much demand, their prices increase, and if the supply increases, their prices decrease.

The advantage of cryptocurrencies is that since they are decentralized, they are not affected by political and economic factors like fiat currencies.

Overall, here are some factors that might influence the movement of cryptocurrency:

Cryptocurrency markets operate 24/7, meaning traders can make money at any time. There’s no best time for trading as price may vary at any time.

While 24/7 trading means more trading opportunities, traders should always implement risk management tools to decrease anxiety.

Margin is the key component in trading with leverage. It is the fractional deposit amount required to open a trade when using leverage.

Margin is simply a percentage of the full amount required to open a position.

For example, you might need to have 10% of the total value required to open a BTC/USD trade on Mitrade. So, to open a position worth $10,000, you would only need $1,000 as a deposit. Not the full sum.

Leverage means using a small amount to open and sustain a larger trade.

The small amount is what we call margin.

Please note that while only the margin is required to open a trade, your loss or profit is calculated based on the full size of the trade.

When trading crypto or other instruments on CFD sites, the money is traded in batches known as lots. A lot is a standardized measure used to determine the size of a trade.

In most cases, a lot will comprise 100,000 units of currency.

However, since crypto tends to be very volatile, their lots are usually smaller and will vary from one broker to the next.

A pip is a measure used to calculate the smallest movement in a cryptocurrency.

For example, when the price of Ethereum moves from $240 to $245, then we say it has moved by 5 pips.

Start Trading Cryptocurrencies with Mitrade

Join Mitrade todayStart trading on Crypto CFDs on the go, 24/7.