Prediction: Here's When We'll See 4% Mortgage Rates Again

Key Points

A 30-year fixed mortgage currently hovers around 6.2%.

The Federal Reserve has begun lowering interest rates at its last two meetings.

Will mortgage rates follow the federal funds rate?

- These 10 stocks could mint the next wave of millionaires ›

In hindsight, consumers who purchased homes during the brunt of the COVID-19 pandemic at ultra-low mortgage rates will likely view that as one of the best financial decisions they ever made. Mortgage rates have soared in recent years due to high inflation, which forced the Federal Reserve to jack up interest rates, and a lack of housing inventory in the U.S. also led to a surge in home prices, making it incredibly difficult for people to afford homes. The median age of a first-time homebuyer is now 40.

With the Fed starting to lower its benchmark overnight lending rate at its last two meetings, many hope mortgage rates will soon follow. Unfortunately, I predict that it could still be a while before rates hit 4% again.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

What influences mortgage rates?

Mortgage rates are heavily influenced by the Fed's key benchmark rate, the federal funds rate, but they're not directly impacted by it. However, the federal funds rate influences the 10-year U.S. Treasury bond rate, which does directly impact the movement of mortgage rates.

But the 10-year U.S. bond rate can also be influenced by market forces such as expectations for inflation and gross domestic product (GDP), so it can move higher and lower, even when the federal funds rate isn't moving, and the 10-year U.S. Treasury bond rate has been highly volatile in recent years.

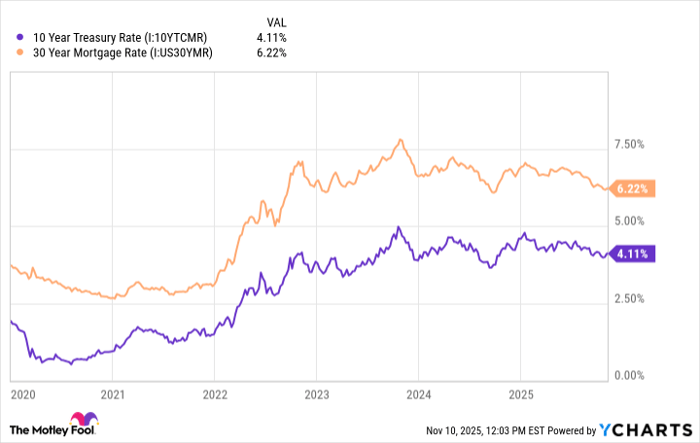

10 Year Treasury Rate data by YCharts

As you can see, the 30-year mortgage rate is roughly 200 basis points (2%) higher than the 10-year rate. There is always a spread built into mortgage rates, so even when the 10-year yield is around 4%, the 30-year fixed mortgage rate will always be higher.

There are two main factors that go into the spread, according to Fannie Mae. One component reflects the cost of originating a mortgage and the margin that lenders make on the loan. The second factor accounts for the additional risk between a mortgage, where there is a borrower that is on the hook for paying back the loan, and the rate of the 10-year Treasury bond, which has the implicit backing of the U.S. government.

Why it could be a while for mortgage rates to return to 4%

Based on the very nature of how mortgage rates are calculated, the 10-year Treasury bond rate would have to decline to close to 2% to see 4% mortgage rates. I don't foresee that happening unless there is a big recessionary event, forcing the Fed to suddenly drop rates.

Following the Great Recession, the Fed spent a decade in zero interest rate policy (ZIRP) mode to re-stimulate the economy, because the Great Recession destroyed trillions of dollars of wealth and led to high unemployment. But the Fed doesn't want to be in ZIRP forever because it wants to have some slack to be able to lower rates if the U.S. were ever to find itself in another recession. The Fed gradually began to increase rates, but the pandemic once again forced the Fed to drop rates to zero and inject stimulus into the economy.

Then inflation hit hard due to fiscal stimulus and pent-up demand caused by the pandemic, forcing the Fed to raise rates extremely fast. The Fed is now lowering interest rates, but I don't think the agency has any desire to lower rates enough to where the 10-year Treasury yield would fall to about 2%. Of course, a recession is certainly possible, given how quickly and intensely the Fed increased rates, but there hasn't been significant evidence yet that the economy will tip into a severe recession.

Other factors also impact mortgage rates, such as the overall economy and inflation expectations. In strong economies with low unemployment, mortgage rates can increase. Inflation expectations also move the 10-year yield.

It's tough to say exactly how these two factors will continue to impact rates. Many have questions about the labor market, but unemployment still remains fairly low from a historical perspective. Inflation is still above the Fed's preferred 2% rate, and there's debate whether it will remain sticky or come back down.

Ultimately, I believe mortgage rates will continue to come down as the Fed continues to gradually lower interest rates. But I don't see mortgage rates coming back down to 4% any time soon, barring some catastrophic recessionary event.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,069%* — a market-crushing outperformance compared to 195% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of November 10, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.