How Crypto and US Stocks Reacted to the Supreme Court’s Trump Tariff Ban

US financial markets and cryptocurrencies moved higher after the Supreme Court struck down former President Donald Trump’s sweeping global tariffs, removing a major source of economic uncertainty.

The court ruled that Trump exceeded his authority by using emergency powers to impose broad tariffs without approval from Congress. The decision limits the president’s ability to reshape trade policy unilaterally and restores Congress as the primary authority over tariffs.

Supreme Court Restores Congress’s Control Over Tariffs

The ruling immediately reshapes the balance of power in US economic policymaking.

The tariffs, imposed under emergency authority, had targeted imports from multiple countries and generated billions in revenue.

Businesses and trade groups challenged the measures, arguing they raised costs and disrupted supply chains. The Supreme Court’s decision now blocks similar tariffs unless Congress explicitly approves them.

Stocks and Crypto Rise as Trade Uncertainty Eases

Markets reacted quickly.

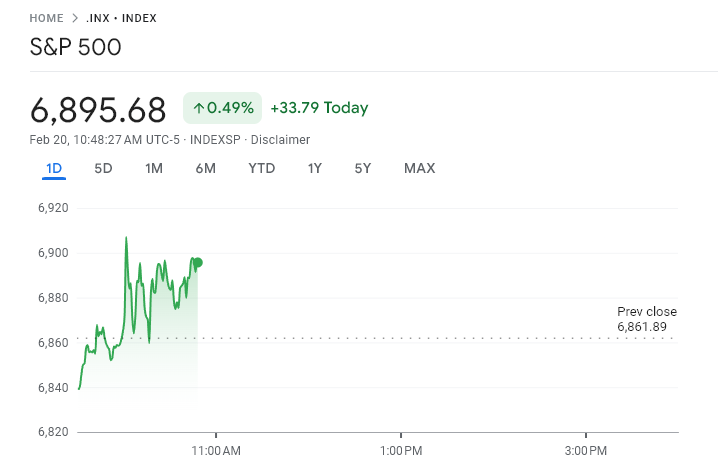

The S&P 500 rose about 0.40%, while the Nasdaq gained roughly 0.70%, signaling renewed investor confidence. Technology stocks led gains, reflecting improved expectations for economic growth and stability.

S&P 500 Surges After Supreme Court Announcement. Source: Google Finance

S&P 500 Surges After Supreme Court Announcement. Source: Google Finance

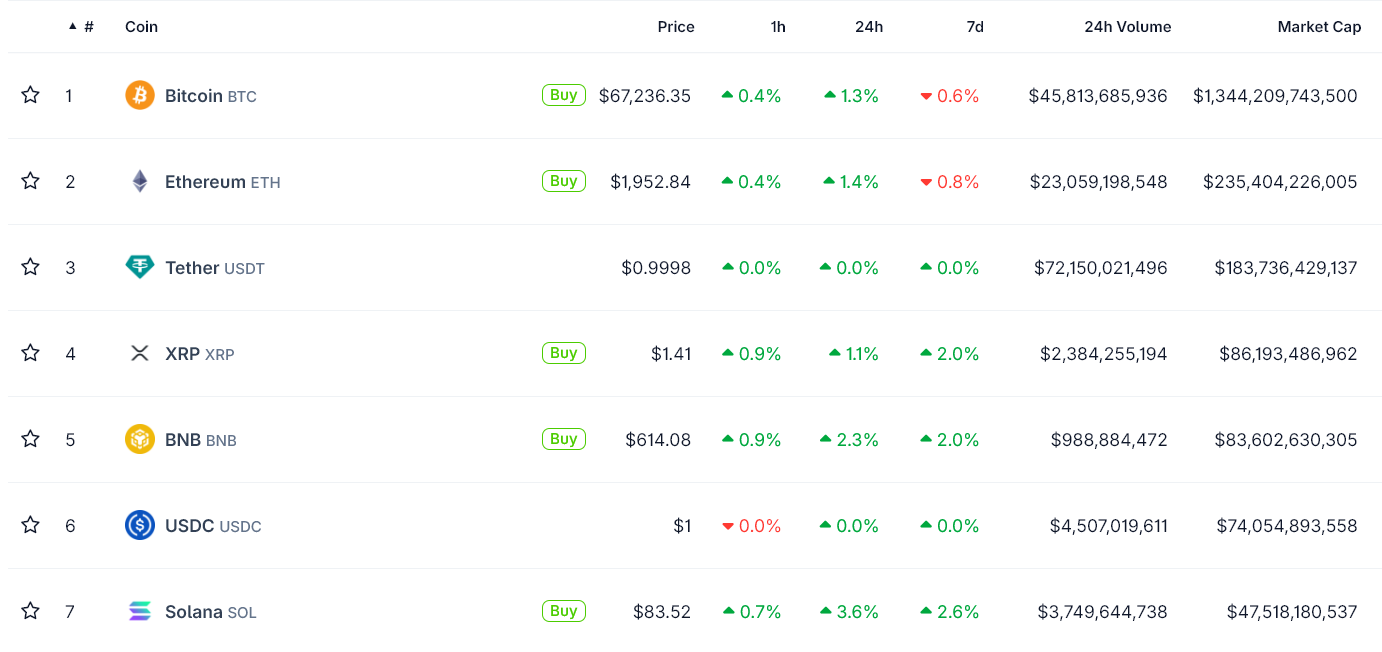

Meanwhile, the global crypto market cap climbed to about $2.38 trillion, with Bitcoin trading near $67,000 after recent volatility.

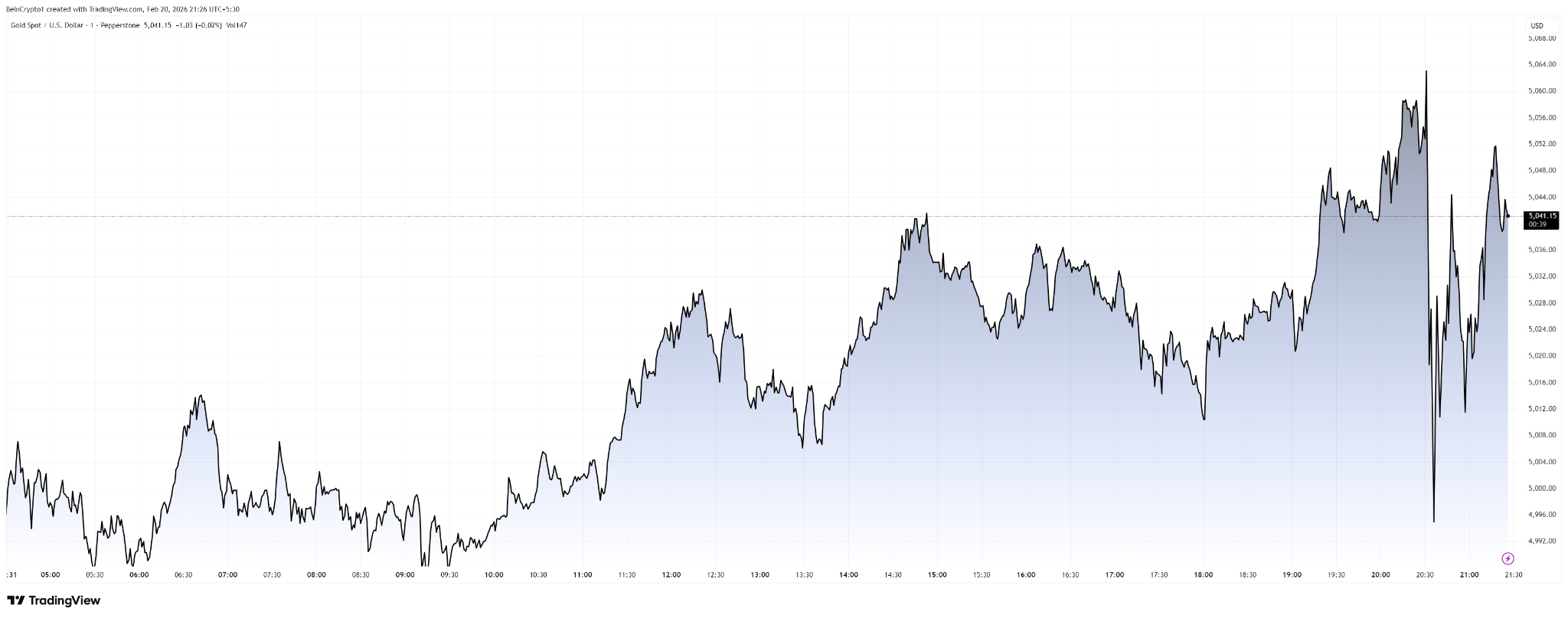

Gold briefly dipped following the decision before recovering, reflecting a shift in risk sentiment.

The market reaction reflects a key shift: reduced trade uncertainty. Tariffs often act like taxes on imports, raising prices and slowing economic activity.

Gold Becomes Extremely Volatile. Source: TradingView

Gold Becomes Extremely Volatile. Source: TradingView

Removing the threat of broad tariffs lowers inflation risks and improves liquidity expectations, both of which support risk assets.

This is particularly relevant for crypto.

Crypto Markets Turn Green. Source: CoinGecko

Crypto Markets Turn Green. Source: CoinGecko

Bitcoin and other digital assets are highly sensitive to global liquidity and investor confidence. When macroeconomic uncertainty declines, capital tends to flow back into riskier assets.

The recovery in crypto alongside stocks suggests investors are regaining confidence after weeks of geopolitical and economic stress.

However, the decision also highlights deeper political tensions. The ruling limits presidential authority and reinforces Congress’s constitutional control over tariffs. This could slow future trade actions but also reduce sudden policy shocks that destabilize markets.

For crypto markets, stability in global trade and economic policy is generally positive. While geopolitical risks remain, the Supreme Court’s decision removes one major macro threat.

In the near term, that shift appears to be supporting Bitcoin and the broader digital asset market.