What is USDC? What are the differences between USDC and USDT? Is it possible to obtain USDC for free?

Foreword

TradingKey - Bitcoin (BTC) surged to an all-time high of $126,000 in October 2025 before correcting over 30% to near $80,000. Despite this downturn, the stablecoin USDC's market capitalization soared.

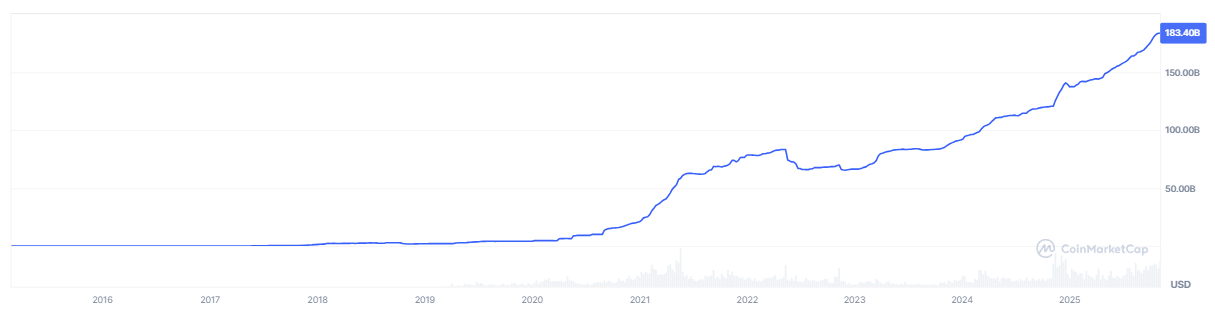

As of December 1, USDC's market capitalization sustained its growth trajectory, increasing by over $3 billion in the past two months. It climbed from $74 billion on October 1 to above $77 billion,setting a new record high.

[Stablecoin USDC Market Capitalization, Source: CoinMarketCap]

What is USDC? What is its function? Furthermore, why is its market cap rising against the trend? This article will provide an in-depth analysis of USDC, exploring itsfeatures, uses, differences from USDT, and how to acquire USDC for free, among other aspects.

What is USDC?

USD Coin, or USDC, is a prominent dollar-pegged stablecoin designed to offer a stable digital asset, reducing user exposure to volatile crypto markets.

USDC was launched in 2018 by the Centre Consortium, a collaboration between leading fintech company Circle (CRCL) and the world's second-largest cryptocurrency exchange Coinbase (COIN). This robust backing fueled USDC's rapid, explosive growth post-launch. In just seven years, USDC's market capitalization has approached $80 billion, with near-universal coverage across public chains.

Project | Details |

Full Name | USD Coin |

Ticker | USDC |

Launch Date | September 2018 |

Issuing Entities | Circle and Coinbase |

Supported Public Chains | Ethereum (ETH), Solana (SOL), Polygon, Avalanche, Tron (TRX), Celo, Near, etc. |

Are USDC and USD the same?

Despite USDC's design to maintain a 1:1 peg with the U.S. dollar, fundamental differences in nature, circulation environment, issuer, and legal status mean they are not entirely the same. Therefore, holding USDC is not fully equivalent to holding U.S. dollars.

USDC | USD | |

Nature | Cryptocurrency | Fiat Currency |

Issuer | Public Company | U.S. Government (Federal Reserve) |

Circulation Environment | Blockchain (Ethereum, Solana, Tron, etc.) | Global financial system, cash, and bank accounts |

Transaction Time | Global 24/7 operation, settles in minutes | Typically has business hour limitations, slower speed |

Value Backing | U.S. dollar cash and short-term U.S. Treasury reserves held by the issuer | Full faith and credit of the U.S. government and legal enforceability |

Legal Status | Not mandatory; acceptance depends entirely on counterparty willingness | Legal tender for all debts within the U.S.; must be accepted |

Regulation and Protection | Subject to financial regulatory oversight but not protected by FDIC insurance | Strictly regulated and protected by the Federal Reserve, FDIC (deposit insurance), etc. |

What are the differences between USDC and USDT?

While both USDC and USDT are dollar-pegged stablecoins,USDC offers greater transparency and compliance, making it more suitable for institutional or corporate clients.In contrast, USDT boasts a larger circulation and wider adoption, favored by retail investors.

Attribute | USDC | USDT |

Issuing Body | Jointly issued by Circle and Coinbase | Tether Limited |

Launch Date | 2018 | 2014 |

Market Cap Ranking | Second-largest stablecoin | Largest stablecoin in the market |

Reserve Assets | 100% US dollar cash + short-term US Treasury bonds, regularly audited by Deloitte | Cash, Treasury bonds, corporate debt, crypto assets; lacks transparency, audit frequency questioned |

Compliance | Regulated by US NYDFS, compliant with EU MiCA | Weaker compliance, previously investigated and sanctioned by the US government, not MiCA-compliant |

Transparency | Monthly publication of full reserve reports, third-party audited | Publishes "Proof of Reserves" but lacks continuous transparent audits |

Target Audience | Institutions and long-term investors prioritizing compliance and transparency | Retail investors and traders seeking liquidity and trading flexibility |

What is the purpose of USDC?

USDC, a prominent dollar stablecoin, possesses dual attributes as both a fiat currency and a cryptocurrency, which defines its broad range of uses as follows:

Use Category | Specific Function | Description | Practical Application Examples |

US Dollar Uses | Asset Preservation | Used as a dollar substitute in high-inflation countries to hedge against local currency depreciation. | Users in Argentina and Venezuela hold USDC for value preservation. |

Cross-border Payments | Facilitates fast, low-cost cross-border remittances. | Fintech companies leverage USDC for international settlements. | |

Everyday Payments | Merchants and Web3 applications accept USDC as a payment method. | Examples include OpenSea NFT marketplace, gaming tips, and subscription services. | |

Cryptocurrency Uses | Stable Value | Pegged 1:1 to the US dollar, exhibiting virtually no price volatility. | Investors convert BTC/ETH into USDC to mitigate risk. |

Medium of Exchange | As one of the primary stablecoins on exchanges, it provides a stable unit of account. | Trading pairs like BTC/USDC and ETH/USDC are available on Binance and Coinbase. | |

Yield Generation | Interest can be earned through various financial products, including lending, interest-bearing deposits, and liquidity mining. | Aave and Compound offer USDC lending services, while Uniswap and Curve host USDC trading pools. |

What are the advantages and disadvantages of USDC?

USDC’s strengths stem primarily from itshigh transparency and compliance, while its drawbacks are linked to itsprivate issuance nature and blockchain technology risks.

Pros | Cons |

Industry's Highest Reserve Transparency:Grant Thornton, a top-tier accounting firm, issues monthly third-party audit reports publicly affirming its reserves are full and sufficient. | Centralized Issuer Risk:Its value relies entirely on the creditworthiness of its issuer, Circle, and its held USD reserves. Should Circle face extreme operational issues or have its reserves frozen, USDC might not be redeemable. |

Highly Compliant:Issuer Circle is a licensed financial institution regulated by the U.S. Office of the Comptroller of the Currency (OCC) and adheres to strict anti-money laundering (AML) regulations. | Lack of Fiat Currency Protection:It is not insured by the FDIC or SIPC. If the exchange holding USDC goes bankrupt, users may not recover their assets in full. |

Safest Reserve Assets:Its reserves are 100% in cash and short-term U.S. Treasuries, bearing almost no credit risk, making it the most conservative stablecoin configuration. | Smart Contract Risk:When used in DeFi protocols, it faces the risk of attacks exploiting vulnerabilities in those protocols' smart contracts. |

Preferred by DeFi Ecosystems and Institutions:Due to its transparency and trustworthiness, USDC has become the preferred, often sole, stablecoin collateral accepted by mainstream DeFi protocols. Furthermore, it is the stablecoin partner of choice for traditional giants like Visa and BlackRock entering the crypto space. | Market Share Disadvantage:On some centralized exchanges, its trading pair volume and depth may still lag behind the older Tether (USDT). |

What is the price and market capitalization of USDC?

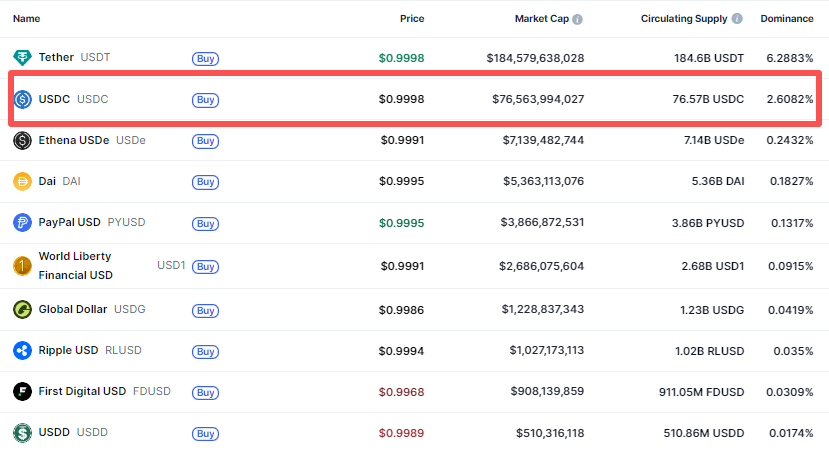

USDC's circulation stands at 76.57 billion tokens, with a market capitalization of $76.56 billion and a market share of 2.60%. It ranks second among all stablecoins, trailing only USDT. Despite their close rankings, a significant disparity exists in their market capitalizations; USDC's volume is less than half that of USDT. Therefore, it is unlikely to unseat USDT's dominant position in the short term.

【Top 10 Stablecoins by Market Cap, Source: CoinMarketCap】

Observant users may have noticed USDC's price at $0.9998. This indicates that USDC is not precisely 1:1 with the U.S. dollar, but insteadfluctuates slightly around it.Historical events demonstrate that USDC can experience significant volatility under extreme conditions, trading substantially above or below the dollar. For example, in 2023, the U.S. banking crisis — triggered by the collapses of Silicon Valley Bank (SVB) and Signature Bank — caused USDC to depeg from the dollar twice.

【USDC Price in USD, Source: CoinMarketCap】

How can I get USDC for free?

Investors can acquire USDC for free through various channels, including exchange education, content creation, and referral programs, despite its maturity as a stablecoin. Details are as follows:

Channel | Method | Estimated Earnings |

Airdrops & Rewards | Exchange Learning Rewards:Complete educational tasks such as watching videos and quizzes on platforms likeCoinbase, Binance, and others. Protocol Airdrops:Participate in DeFi protocols that have not yet issued their native tokens, with the potential for future airdrops. | Varies from $3 to $50 |

Participate in Staking & Liquidity Mining | Stake Native Tokens:Stake native tokens on supported networks (e.g., Polygon); rewards are sometimes paid in USDC. Provide Liquidity:Supply liquidity for USDC-containing trading pairs on decentralized exchanges (e.g., Uniswap) to earn transaction fees and governance token rewards. | Approximately 2%-20% annualized |

Earn Platform Rewards | Referral Bonuses:Refer friends to register and trade, with both parties receiving rewards (e.g., Coinbase offers $10). Daily Check-ins & Tasks:Participate in daily check-ins or simple tasks on platforms like Celsius and Nexo. | Varies from $10 to $100 |

Content Creation & Contributions | Donate to open-source projects on Gitcoin (receiving matching funds), participate in DAO translations, or create articles and short videos on platforms like Binance Feed to earn rewards. | Variable |

It is crucial to note that while these methods are free, they demand time, attention, and expose participants to market or technical risks. Furthermore, investors should never click on unsolicited links or fall victim to scams asking for upfront USDC, private keys, or seed phrases.

Conclusion

USDC, the world's second-largest stablecoin, touts transparency and compliance as key advantages. While trailing USDT, it aims to lead the "compliant stablecoin" sector, but investors must acknowledge potential risks. Despite its market share still lagging USDT, USDC is poised to become the definitive "compliant stablecoin" as regulations tighten and collaborations with financial institutions deepen. Furthermore, while investors can acquire USDC for free through specific channels, vigilance regarding its potential risks remains crucial.